Corporate Governance: Could Japan be a model for Korea?

PERSPECTIVES | No. 31

- Inefficient industrial conglomerates such as Japan's keiretsu and Korea's chaebol have long weighed on local equity markets.

- In Japan, corporate governance reforms are already driving noticeable improvements in company valuations.

- South Korea's "Corporate Value-Up" programme relies on voluntary measures.

- Both markets are becoming more attractive to investors, as the reforms open up new opportunities across Asia.

For many years, the term 'Deutschland AG' stood for a tightly interconnected network of major German corporations and banks. While long seen as a stabilising force within the German economy, it was also criticised for its lack of transparency, inefficient capital allocation, and limited openness to competition. In equity markets, the dense web of cross-shareholdings and corporate ties led to low valuations and a generally sluggish market environment.

Similar to Germany in the 1990s, large industrial conglomerates – known as keiretsu in Japan and chaebol in South Korea – continue to shape the economic landscape. In Korea in particular, the influence of the chaebol is striking: in 2021, the ten largest chaebol accounted for an impressive 60% of the country's GDP. This concentration has given rise to a distinct phenomenon: the so-called "Korean discount". Compared to global peers, Korean equities often trade at lower price-to-earnings ratios. Investors remain cautious due to the structural issues surrounding these conglomerates, resulting in valuations that do not fully reflect the companies' underlying performance. As a result, many Korean stocks remain undervalued despite solid fundamentals.

Japan has already made progress in dismantling its conglomerate structures. The Tokyo Stock Exchange (TSE) has launched several initiatives aimed at improving equity valuations among Japanese companies. Firms trading below book value were initially required to present plans to enhance capital efficiency, strengthen governance standards, and improve shareholder engagement. In addition, they were encouraged to either raise dividends or implement share buybacks.

Japan: an increasing number of companies are taking steps to improve capital returns and share price performance

Prime and standard segments

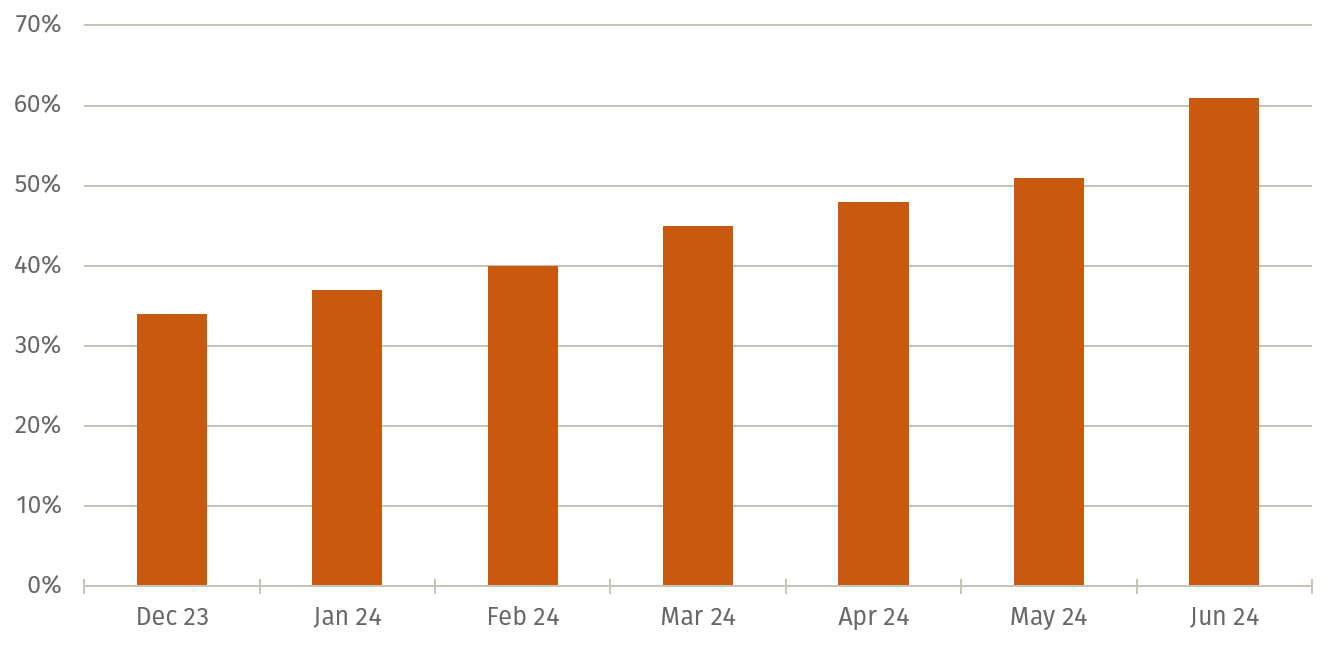

The programme has since been extended to all companies listed in Japan’s Prime and Standard segments. Since January 2024, the TSE has published a monthly updated list of firms that have taken concrete steps to improve capital returns and share price performance. The aim is to incentivise companies to align their business strategies more closely with shareholder interests. Those failing to act face public naming, increasing the pressure to deliver improvements. This approach is showing results: the share of companies implementing such measures rose from 34% at the beginning of the year to 61% by June.

In South Korea, the government is pursuing a different approach with its "Corporate Value-Up" programme, focusing on voluntary measures to improve efficiency and capital allocation among the chaebol. Introduced in May, the initiative calls on companies to develop and disclose long-term plans aimed at enhancing corporate value. To encourage participation, the government is considering financial incentives such as tax benefits and potential inclusion in a newly created "Korea Value-Up" index. In contrast to Japan, Korea relies not on public pressure or naming and shaming, but on voluntary engagement and positive incentives.

For the investor

The reforms in Japan are already showing positive effects. In South Korea, the new corporate governance measures are also expected to provide long-term support, even if their impact may be less pronounced than Japan's "name and shame" approach. In any case, both Japan and Korea are becoming increasingly attracttive to investors seeking to diversify away from tightly regulated European markets or to strengthen their exposure to Asia – without taking on the geopolitical and regulatory risks associated with other countries in the region.