Correlation dilemma and inflation pressure: A new reality for multi-asset funds?

PERSPECTIVES | No. 32

- The positive correlation between equities and bonds observed since 2022 challenges the traditional diversification approach of many multi asset funds.

- Persistent inflationary pressure and interest rate volatility are the key drivers behind this correlation.

- Modern multi asset strategies can help address the implications of this shifting macroeconomic environment.

Diversification across equities and bonds has long been a cornerstone of many multi-asset funds. Over the past two decades, the typically negative correlation between the two asset classes made life relatively easy for fund managers: losses in one segment were often offset by gains in the other. This helped reduce overall portfolio volatility and kept maximum drawdowns relatively contained. As a result, many balanced funds with a core allocation to equities and (government) bonds historically achieved an attractive risk-return profile.

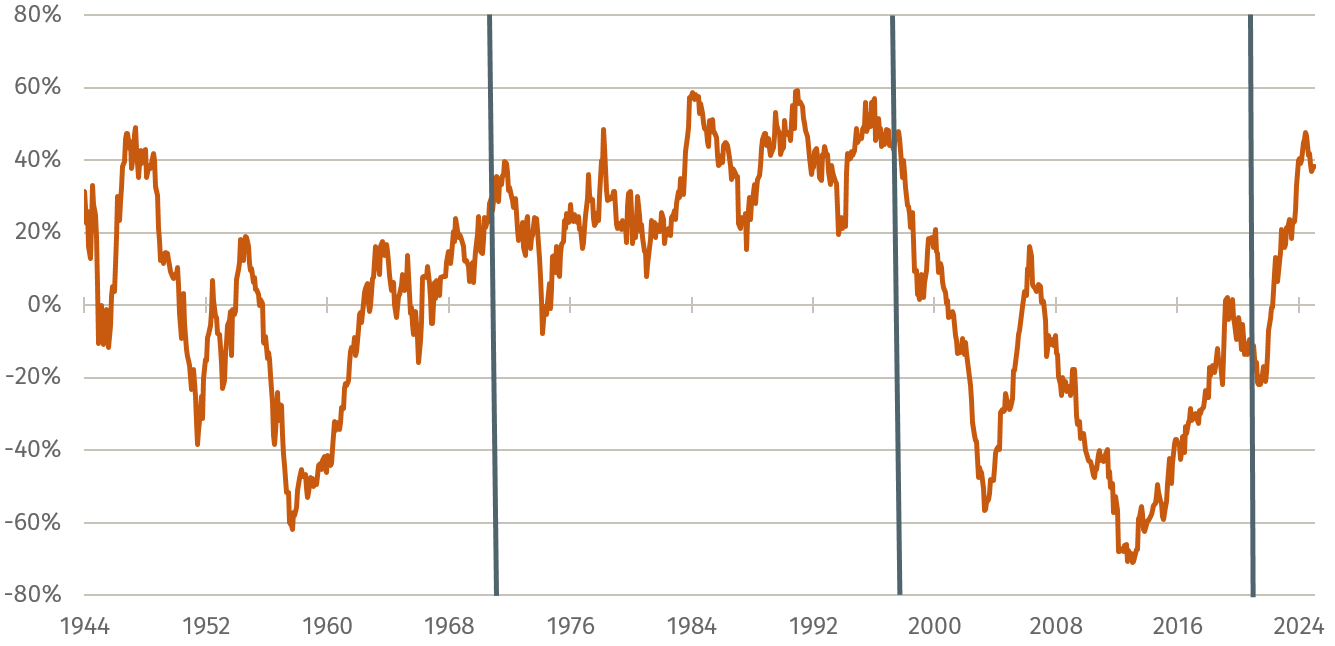

Figure 1: Historical correlation trends in the US

Rolling three-year correlation between equities (S&P 500®) and bonds (10Y US Treasuries), based on monthly returns

Historical developments in equity–bond correlation

Historically, a negative correlation between equities and bonds has been the exception rather than the rule. Figure 1 illustrates the rolling three-year correlation for the United States from 1944 to January 2025. Between 1944 and 1971, the Bretton Woods system – with fixed exchange rates and a gold standard—created a stable but rigid environment for capital markets, during which equity–bond correlations remained largely moderate. Following the collapse of Bretton Woods and the introduction of floating exchange rates, the period from 1971 to 1999 was characterised by an almost consistently positive correlation between the two asset classes. During this time, the global economy struggled with rising inflation driven by oil price shocks and heightened volatility. Central banks attempted to rein in inflation through aggressive interest rate hikes.

It was not until the late 1990s, with the introduction of forward guidance and inflation targeting by major central banks, that the correlation turned negative. In the 2010s, this negative equity-bond relationship was further reinforced by the so-called central bank "put". This referred to the widespread expectation that central banks –most notably the US Federal Reserve and the ECB – would respond to market turmoil with interest rate cuts or bond purchases, thereby cushioning equity declines. Whenever real economic conditions weakened and equity markets fell, investors anticipated monetary easing, which led to falling yields and rising bond prices. Since 2022, however, equities and bonds have once again moved in tandem. Today’s situation mirrors aspects of the 1970s and 1980s: surging inflation – driven by the energy crisis, supply chain disruptions and monetary expansion – has forced central banks into a sharp policy reversal, marked by rate hikes and the end of bond-buying programmes. How can these periods of positive correlation be understood from a macroeconomic perspective? Fundamentally, there are two key drivers: elevated inflation and increased interest rate volatility.

Elevated inflationary pressure

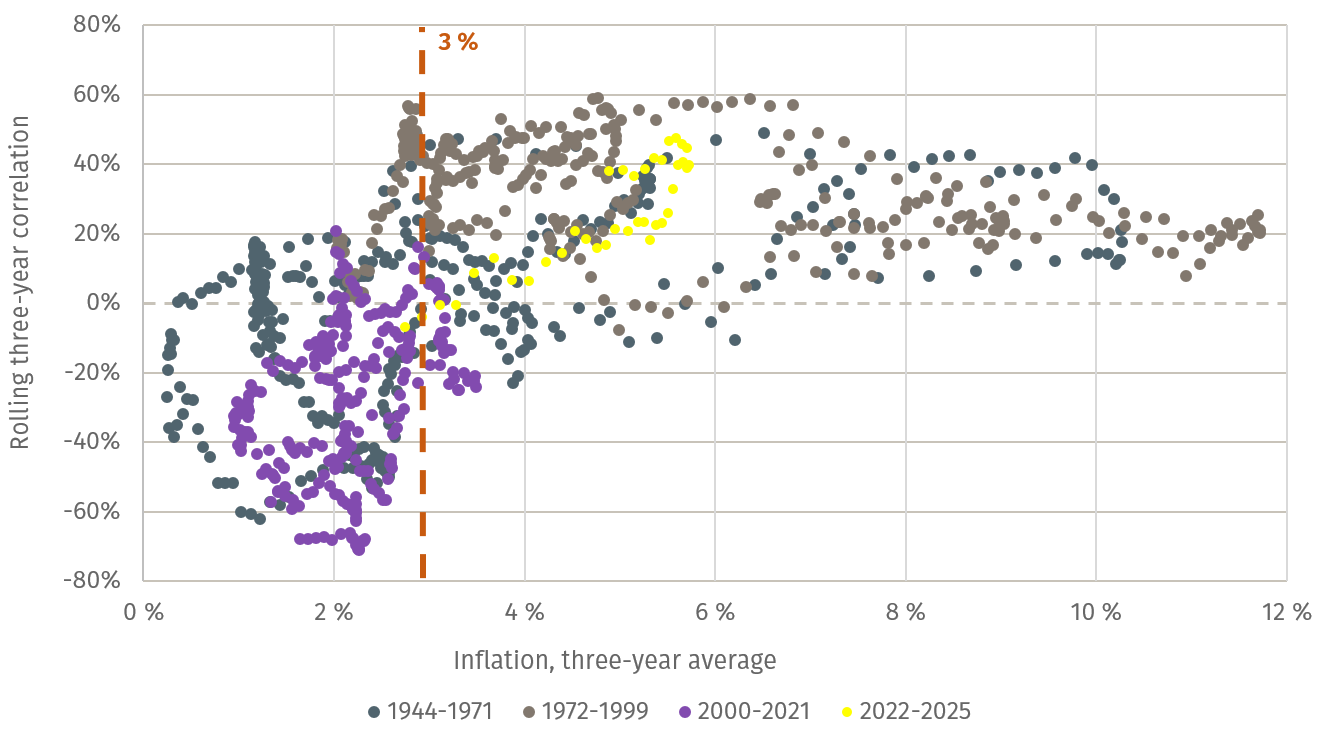

Rising inflation affects the two asset classes in different ways. Fixed income securities inevitably lose value when prices rise, as fixed coupon payments and final repayments are eroded in real terms. To compensate for this loss, coupons must increase – this, in turn, means falling bond prices. On the equity side, the effects of inflation are less straightforward. Companies with pricing power can pass rising input costs – such as raw materials, energy, or wages – on to consumers. By contrast, firms in highly competitive industries or with price-sensitive demand are often unable to do so, leading to margin pressure, declining profitability and falling valuations. In addition, the market tends to discount future earnings more heavily in an inflationary environment. Historically, inflation has had a more negative impact on equities once it exceeds the 3 to 4 percent range. Figure 2 illustrates that when inflation remained persistently above 3 percent, the correlation between equities and bonds was positive in nearly 90 percent of observations.

Elevated interest rate volatility

Another key link closely tied to inflation is the role of interest rates. As the general price level rises, central banks are forced to tighten monetary policy—typically through rate hikes or the unwinding of bond holdings. These measures cause bond prices to fall and simultaneously weigh on equity markets. Higher interest rates lead to a stronger discounting of future corporate earnings, putting pressure on share prices. At the same time, rising refinancing costs can hinder corporate investment and dampen profit growth. Conversely, when central banks cut policy rates, bond prices tend to rise, while cheaper capital market financing generally supports equity valuations. In both scenarios, the correlation between equities and bonds tends to be positive.

However, a highly volatile outlook for future interest rate moves can also trigger abrupt price swings in both asset classes. When market participants frequently revise their expectations within short time frames, this increases rate volatility and leads to frequent portfolio reallocations. These adjustments can put pressure on both equities and bonds, as sudden changes in yield expectations often prompt equally sharp bouts of selling or buying. In an environment where monetary policy is strongly data-dependent and investors react to every new economic signal, elevated interest rate volatility can, at times, push both asset classes in the same direction.

Positive correlation likely to persist

There are several reasons to believe that the correlation between equities and bonds may remain positive going forward. First, inflation has proven more persistent in both the United States and Europe than many economists initially expected. This is primarily due to second-round effects driven by strong wage growth. In addition, structural factors such as a shortage of skilled labour continue to push up wages in certain sectors. As a result, core inflation stood at 3.3 percent in the Eurozone and 3.2 percent in the US as of December 2024, with service sector prices rising by as much as 4 and 4.5 percent, respectively. In this context, inflation rates between 2 and 4 percent would not be surprising in the years ahead. Second, in such an inflationary environment, central banks have limited scope for large-scale rate cuts or renewed bond purchases. Policymakers are currently struggling to provide a reliable outlook for the future path of monetary policy. A central bank "put" of the kind seen in the previous decade is no longer fully available. Third, history shows that correlation regimes can persist for decades. Once established, such regimes often remain in place for extended periods and typically require fundamental macroeconomic shifts to be reversed.

For the investor

In light of persistent inflationary pressure, a more restrictive monetary policy stance than in the past, and a currently positive correlation between equities and bonds, investors must adapt to a changing market environment. Where a simple mix of the two asset classes once delivered robust diversification, today's conditions demand greater foresight. Modern multi-asset portfolios rely on multiple sources of return, adjust dynamically to shifting market regimes, and actively deploy a range of instruments and strategies to manage risk. While the objective remains to combine stability and growth within a single portfolio, achieving this has become more complex. In particular, the combination of macroeconomic analysis, flexible asset allocation, and the inclusion of additional asset classes can help navigate these new challenges—and potentially deliver a more attractive risk-return profile over the long term than conventional approaches in many market scenarios.

This article was first published on 13 February 2025 on the Börsen-Zeitung website.