The other side of value

EQUITY INSIGHTS | No. 40

- There are inherent limits to constructing multi-factor portfolios: not all factors combine effectively.

- In particular, Value & Size as well as Quality & Momentum are especially complementary.

- Given the current market structure, these two combinations represent highly synergistic strategies.

The limits of the multi-factor portfolio

The main challenge in designing multi-factor strategies is to construct portfolios that are well diversified while maintaining strong exposure to the desired factor premia.

Regardless of the construction method – from simple ranking approaches to more integrated portfolio designs – there are natural limitations, as not all factors combine meaningfully. In practice, supposed multi-factor portfolios often end up with significant exposure to only one or two factors, and may also carry unintended side effects, leading to underwhelming outcomes. This is typically due to the failure to account for interdependencies between factors.

A clear example is the relationship between Value and Quality. As capital market researcher Robert Novy-Marx demonstrated in 2012, high-quality companies tend to trade at higher valuations – in effect, Quality represents the other side of Value.

Table 1 confirms, based on current data, that the dependencies identified by Novy-Marx remain valid. The correlations between the underlying company fundamentals show that Value (valuation metrics) is negatively correlated with both profitability and leverage indicators.

Tab. 1: Correlations of selected factor exposures

Managing factor exposure despite negative correlation

In other words: companies with low valuations still tend to exhibit below-average profitability and elevated leverage, while firms with strong profitability and low debt typically trade at higher valuations.

While it is not feasible to significantly emphasise both factors simultaneously within a single portfolio, it is possible to control for one while targeting the other. In constructing a pure Value or Quality strategy, factor neutrality can be maintained relative to the broader universe. For Value investors, this means preserving a certain level of Quality to avoid the typical pitfalls of uncontrolled Value strategies—namely, the "value trap." Although this approach may slightly reduce Value exposure, in line with the negative correlation previously discussed, the improvement in portfolio Quality more than compensates for it.

So, which factors can be effectively combined? First, it’s important to recognise that the Quality factor is, in itself, a multi-factor construct – comprising profitability and leverage. These two characteristics are positively correlated and can therefore be efficiently integrated within a single portfolio. By contrast, for constructing a multi-factor portfolio centred on Value, suitable combinations include Dividend, Size, or Low Risk (i.e. idiosyncratic volatility and beta), as these factors complement Value without introducing conflicting exposures.

Assenagon Equity Framework

Additional factors can also be incorporated within the Quality (multi-factor) portfolio. Momentum is particularly notable, as it correlates positively with both profitability and leverage. Within the Assenagon Equity Framework, all other return drivers beyond the targeted factors are neutralised. This allows for the efficient construction of a portfolio combining profitability, leverage, and momentum, while maintaining a neutral valuation (i.e. neutral Value exposure) relative to the global equity market.

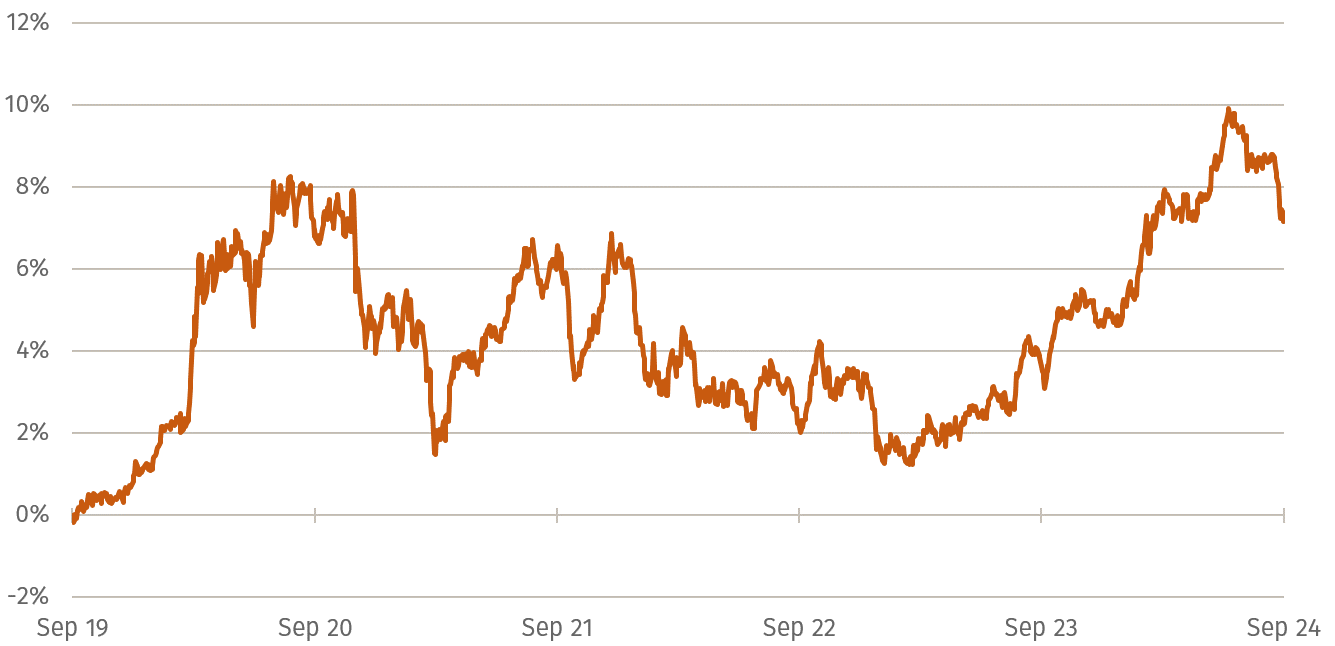

Figure 1 shows the performance of the Quality Momentum multi-factor portfolio relative to the global equity market. Apart from the targeted factor exposures, all other return drivers (factors, sectors, and countries) have been neutralised. Over the past five years, this strategy has delivered an outperformance exceeding 7%.

Fig. 1: Relative performance – global equity market ratio

(September 2019 – September 2024)

For the investor

Table 1 clearly shows that there are only a limited number of truly efficient multi-factor portfolios, with the combinations of Value and Size as well as Quality (Profitability and Leverage) and Momentum standing out. Given recent developments in the global equity market, these two approaches offer compelling and highly complementary strategies. The current market structure, dominated by mega-caps exhibiting Quality and Momentum characterristics, allows for an efficient implementation of a Quality Momentum portfolio without elevated valuations. In contrast, Value and Size represent factors that run counter to the prevailing market environment.

Over the long term, each factor independently generates outperformance versus the global equity market. However, meaningful diversification in factor allocation remains worthwhile, as different factors come into focus depending on the market environment, as illustrated in Figure 1.

To quote Novy-Marx:

Profitability stocks typically have lower book-to-market ratios and higher market capitalisations. They provide an excellent hedge against value strategies, thereby significantly enhancing

a value investor’s opportunity set.

PS: In the next issue, read how the well-known factors performed during the mega-cap dominated year of 2024.