Global economy: Optimism is warranted

PERSPECTIVES | No. 30

- The economic turbulence of recent years seems to be behind us.

- Falling inflation, rising purchasing power, and technological progress are supporting global growth.

- Equity markets are likely to benefit from the current environment.

The past four years have been exceptionally turbulent for the global economy and financial markets. The collapse of international supply chains, unprecedented monetary and fiscal interventions, Europe's energy crisis, a sharp surge in inflation, and a globally synchronised tightening of monetary policy have left a lasting mark on economic sentiment and put the foundations of many economies to the test. Confidence remains particularly low in Europe and Germany. In our view, however, this pessimism is unwarranted. There is good reason for optimism, as several indicators now point to the beginning of a global upswing

Resilience of the global economy

Once again, the global economy has proven more resilient than widely expected. The gloomy forecasts of many economists have so far failed to materialise. Strong growth in the United States and major emerging markets – particularly India – has largely offset the weakness in Europe. Supported by rising demand, global trade is also showing signs of recovery. Looking ahead, export-oriented countries such as Germany are likely to benefit and may expand in the slipstream of major trading powers like the US and China.

Stable labour market

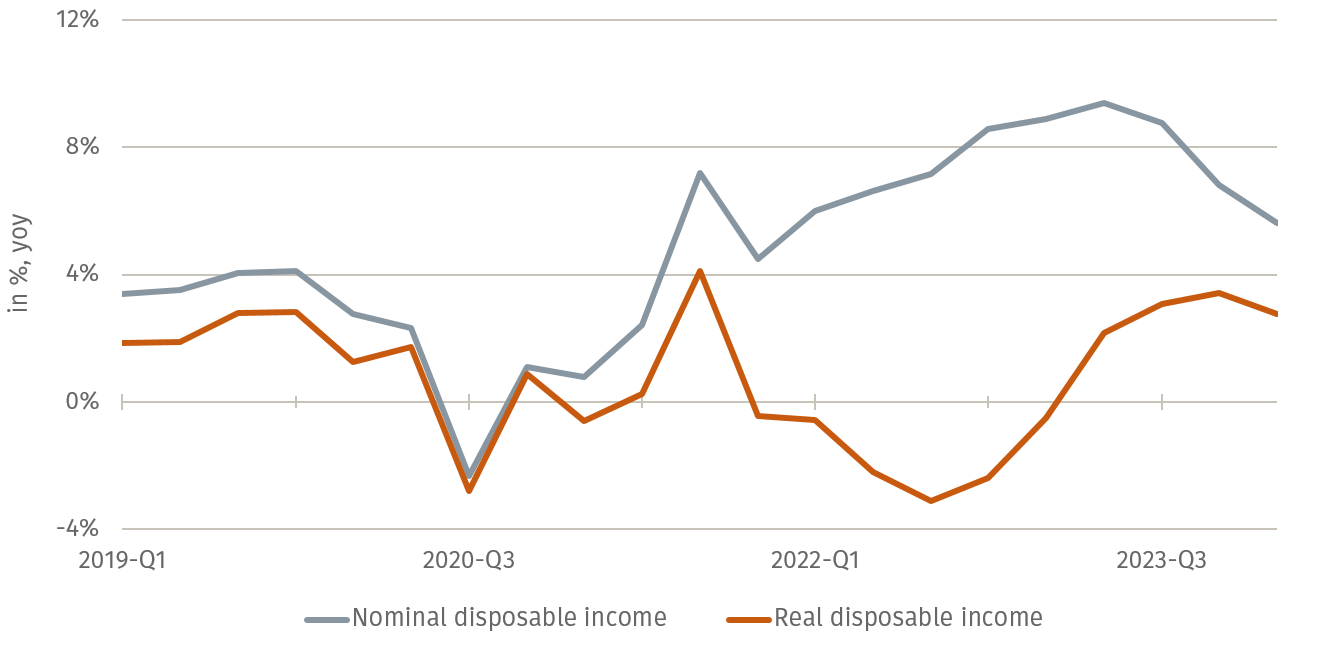

The global labour market remains remarkably resilient. Unemployment in many developed economies is hovering near record lows. Despite subdued economic momentum, the jobless rate in the Eurozone, for example, stands at just 6.5 percent – its lowest level on record. Combined with declining inflation, this has led to rising real wages. As a result, consumer confidence is improving and domestic demand is picking up, with more income available to spend on goods and services.

Declining inflation

The elevated inflation of the past two years appears to be fading as quickly as it arrived. Higher interest rates, driven by tighter monetary policy and lower energy prices are already having a clearly dampening effect on inflation. Unlike the 1970s and 1980s – when inflation in developed economies remained persistently high between 5 and 15 percent for over a decade – price pressures have not become entrenched at those levels this time. A softer inflation backdrop increases the room for interest rate cuts by central banks this year, which could further support economic activity. However, it is too early to declare victory over inflation. Wage increases in several sectors suggest that inflation dynamics could shift again.

Technological progress

The rollout of new technologies – particularly artificial intelligence (AI) – is at the heart of potential productivity gains across many economies. These innovations are not only key to enhancing competitiveness but also play a major role in improving overall economic performance. There remains considerable growth potential: according to a study by the European Investment Bank, only around one third of companies in the US and Europe are currently using AI in day-to-day operations.

For the investor

Of course, downside risks to the global economy remain. These include ongoing geopolitical conflicts and wars, rising protectionism, regulatory barriers, and in some cases, high levels of government debt. Nonetheless, there are strong reasons to be optimistic about the second half of the year. The recent record highs in equity markets appear justified – and there may still be further upside potential. That said, investors should maintain a balanced investment strategy that captures opportunities in high-growth sectors while managing risk through careful diversification. This approach allows investors to benefit from positive economic momentum while also protecting their portfolios against potential setbacks.